AI agents excel at one thing: processing data and making smart decisions. Give them market information, user preferences, and protocol data, and they'll construct the perfect strategy in seconds.

But here's where every AI agent hits the same wall: execution.

The AskGina team understood this problem better than most. They had built an AI that could analyze cross-chain opportunities, understand user intents, and construct optimal transaction paths. Their agent could tell you exactly how to move USDC from Optimism to BNB Chain, swap it to BNB, and execute at the best possible rates, yet actually making it happen was the hard part.

The Execution Problem

AI agents are brilliant at analyzing thousands of variables, comparing routes, and optimizing for the best outcomes. But when it comes to onchain execution, they hit fundamental limits.

Take a simple bridge operation.

An AI agent can identify the optimal bridge, calculate timing, and construct transaction data. But what happens when gas prices spike mid-execution, or a chosen route reverts? Traditional systems retry the same failed path, and the agent, bound by deterministic logic, can’t dynamically adapt.

Execution today is still fragmented, switching networks, handling confirmations, juggling gas tokens, and managing RPC reliability. This creates friction that undermines the very point of automation. If users still need to babysit their AI agents, why use one at all?

“AI agents are perfect for the what and how of DeFi operations,” explains the AskGina team. “But they need a reliable partner for the make it happen part.”

The Solution: Best of Both Worlds

That’s where Biconomy came in.

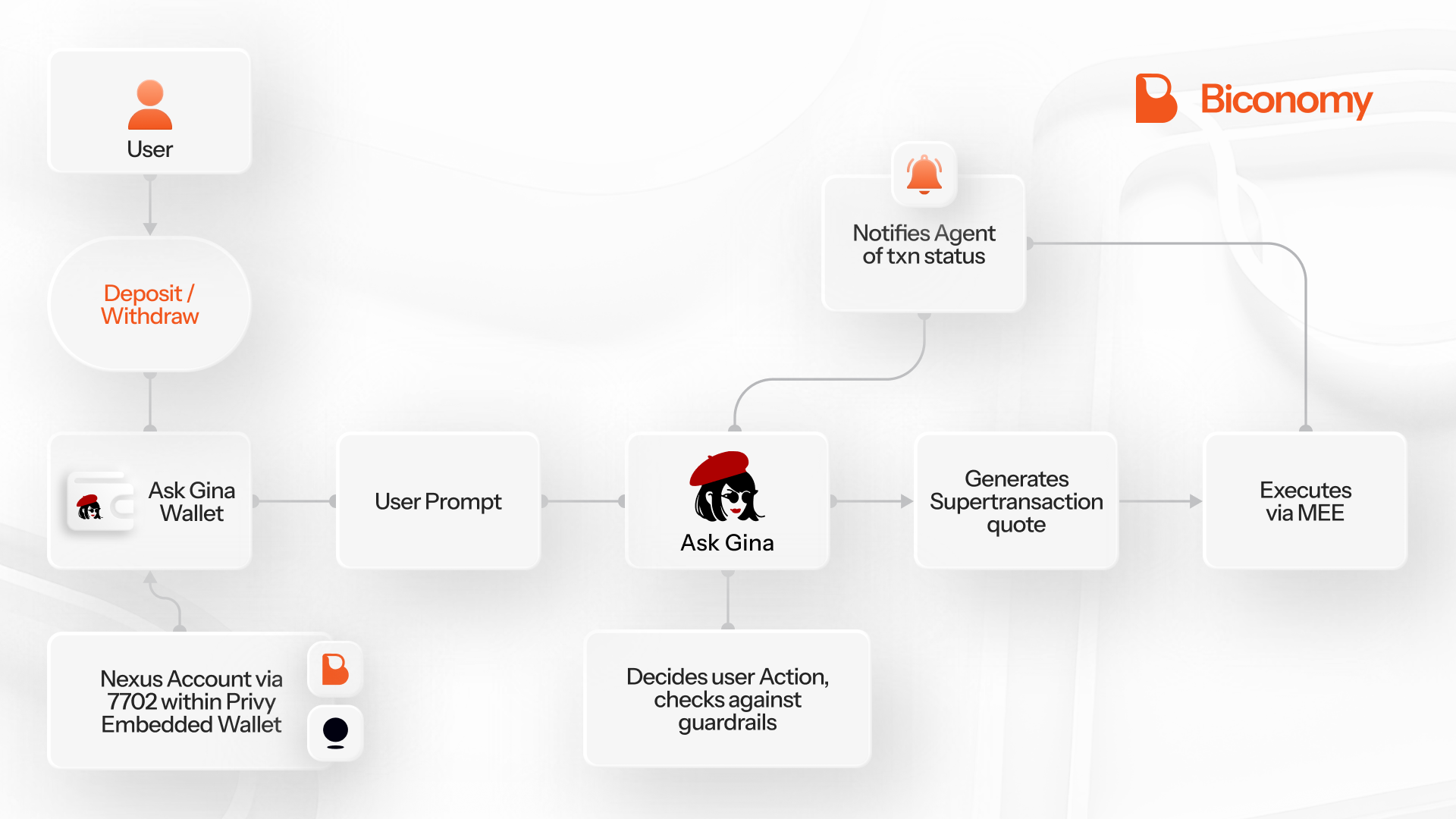

The integration connected AskGina’s intelligence layer to Biconomy’s Modular Execution Environment (MEE) - a modular orchestration layer built for gasless, multichain execution. The setup used the AbstractJS SDK, and Nexus Smart Accounts to bridge intent generation and deterministic completion.

AskGina’s AI handles the intelligence layer: analyzing data from any token, including even your chosen memecoins, comparing DeFi routes, and building intent structures. Biconomy’s MEE handles the execution layer: routing transactions across chains, abstracting gas payments, and managing fallback strategies with automated re-execution logic.

Each stack stays in its strength zone.

- The AI focuses on optimizing outcomes.

- The MEE orchestration guarantees delivery, with built-in recovery and gas optimization.

- The Nexus accounts provide a unified multichain identity that preserves user control and enables sponsorship or ERC-20 gas payments.

This modular setup lets the AI orchestrate Supertransactions, composable, multi-step workflows executed under one hash with atomic guarantees.

How It Works in Practice

When a user says, “get me $5 exposure to ETH using my USDC on Base,” here’s what happens behind the scenes:

- AskGina AI Agent

Parses the natural language input into a structured intent. It then uses internal modules to construct a multi-step Supertransaction, for example, swap → bridge → swap — and pre-simulates outcomes.Guardrails like balance checks, slippage bounds, and failure thresholds are applied before the intent is passed downstream. - AbstractJS Integration

The AI converts this intent into onchain calls using AbstractJS, Biconomy’s SDK that interfaces with MEE and Nexus. The SDK packages the logic into executable transaction objects with runtime parameter injection. - Biconomy’s MEE Orchestration Layer

MEE takes over execution. It dynamically optimizes gas limits, handles partial failures, and automatically retries alternative paths. If a bridge fails or a token pair lacks liquidity, MEE re-routes through more optimal solvers, like LiFi or Across.All of this happens through the Nexus Smart Account, a chain-abstracted account standard that preserves ownership, handles gas abstraction, and ensures composability across networks. - Completion & Feedback

Once execution completes, the AI receives structured feedback, transaction receipts, gas metrics, and performance outcomes, which it can feed back into its decision model to improve future strategies.

The user only sees one thing: their intent executed successfully, end-to-end.One prompt, one confirmation, one hash.

In production, users complete an average of 1.46 swaps per Supertransaction, meaning each execution often includes more than one onchain action batched into a single transaction, a significant UX and efficiency gain.

Beyond Onchain Execution

The collaboration also laid the groundwork for off-chain Supertransactions, enabling the agent to combine both onchain and offchain steps, such as TWAPs, limit orders, or predictive strategies that run partially outside the blockchain but settle trustlessly via Nexus accounts.

This hybrid orchestration gives AI agents new capabilities: to monitor, delay, or conditionalize transactions across time without requiring manual interaction.

Real Results from Real Users

Real Results from Real Users

Since integrating Biconomy, AskGina’s agent has gone far beyond proof of concept.

In production, it has already processed:

- 8,000+ swaps executed

- 700+ distinct tokens swapped

- $3 million+ in total transaction volume

These metrics reflect both operational scale and liquidity diversity — real users performing real onchain actions across multiple ecosystems.

Approximately 20% of all swaps were cross-chain, showing how the orchestration layer is actively bridging assets between networks. The average swap size (~$375) highlights strong user engagement and meaningful capital movement.

“The integration reduced our development time from weeks to days,” the AskGina team shared. “More importantly, it let us focus on improving our AI instead of debugging blockchain infrastructure.”

Why This Matters for AI Agents

This collaboration proves that AI agents don’t need to rebuild every layer of blockchain infrastructure. The future belongs to modular systems, intelligent agents that handle reasoning and optimization, paired with specialized infrastructures that handle execution and reliability.

With Biconomy, AI agents get composable execution guarantees, gas abstraction, and cross-chain orchestration out of the box.With AskGina, users get intelligent automation that actually delivers what it promises.

The Bigger Picture

The AskGina-Biconomy partnership represents a new pattern for AI-native systems: intent-driven execution powered by modular infrastructure.

Instead of siloed development, it’s a symbiotic model:

- AI for intelligence and strategy.

- Biconomy for orchestration and completion.

For users, that means DeFi agents that truly “just work.”For developers, it means faster time-to-market, smaller stacks, and reliable composability across chains.

AI agents now have their missing half, a modular execution layer that can make their decisions real.

Ready to give your AI agent execution superpowers?

Learn how to integrate Biconomy’s Modular Execution Environment:Docs | Try AskGina