Ask any liquidity provider what their least favorite part of DeFi is, and you'll hear the same answer: constant monitoring.

Pools drift out of range. Volatility spikes. Optimal positions become suboptimal in hours. You're either glued to your screen or you're losing efficiency. Some LPs set alarms for 2 AM to check positions. Others just accept the missed yield.

The KOPS team saw this problem differently. What if your capital could watch the markets for you? What if positions could rebalance themselves when conditions changed? Not through a static vault that locks you in, but through an agent that adapts in real-time.

They built it. And it works.

Real Results from Real Users

Since integrating Biconomy, KOPS has gone far beyond proof of concept.

In the first four days post-launch on HyperEVM, the platform processed:

- $4 million+ in volume

- Automated range adjustments across multiple pools

- Zero manual interventions required from users

- High yields compared to manual management strategies

These metrics reflect operational scale and real capital movement. Users are depositing funds, letting agents manage positions, and earning optimized returns without touching their wallets.

The Execution Problem

The challenge wasn't building the intelligence layer. Analyzing pool performance, calculating optimal ranges, detecting market shifts - that's solvable with good models and clean data feeds.There were two large challenges for the team.

Analyzing pool performance, calculating ranges, detecting market shifts with an AI overlay for effective optimization and learning, which they solved.

The second massive one was execution on-chain.

Here's what rebalancing a liquidity position actually requires:

You need to withdraw from the current pool. That's one transaction. Then you need to approve tokens for the new position. That's another transaction. Then deposit into the new range. That's a third transaction. Each step needs gas. Each step can fail. Each step requires a signature.

And you need to do this fast. The longer you're out of position, the more yield you're missing.

Now imagine doing this across multiple pools. Multiple chains. Multiple protocols. The complexity explodes. Most LPs just don't bother. They set a position and hope it stays optimal. When it doesn't, they eat the loss.

The Solution: Agents That Actually Execute

That's where Biconomy came in.

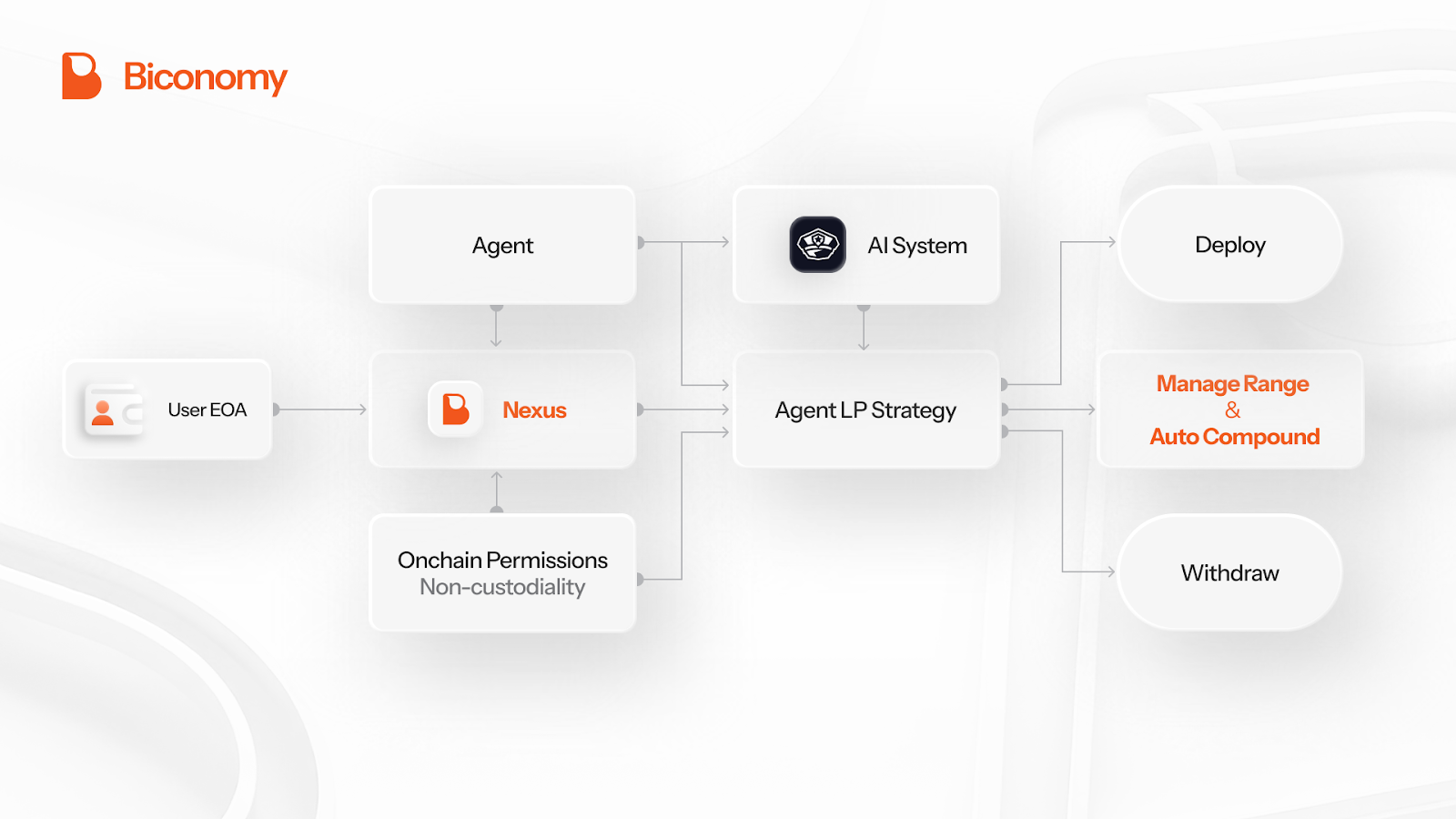

The integration connected KOPS' intelligence layer to Biconomy's supertransaction stack, a modular orchestration system built for gasless, and composable multichain execution. The setup used session keys, Nexus Smart Accounts, and the AbstractJS SDK to bridge intent generation and deterministic completion.

KOPS' agents handle the intelligence layer: analyzing real-time data from HyperEVM, comparing pool performance, and building execution strategies. Biconomy's infrastructure handles the execution layer: bundling operations into single transactions, abstracting gas payments, and managing permissions without touching private keys.

Each stack stays in its strength zone.

The agent focuses on when and where to rebalance. Biconomy's supertransaction orchestration guarantees execution, with built-in gas optimization and atomic guarantees. The Nexus accounts provide a unified identity that preserves user control,allows for sponsored transactions and secure onchain delegation.

This modular setup lets agents run Agentic Liquidity Pools (ALPs), through Supertransactions, collapsing multi-step logic into a single, guaranteed execution under one hash.

How It Works in Practice

When a user deposits funds into KOPS, here's what happens behind the scenes:

KOPS Agent The agent monitors millions of on-chain data points in real-time: asset prices, liquidity depth, pool performance, and market sentiment. It uses predictive models to forecast yield sustainability and avoid "yield traps." When conditions change, the agent constructs a multi-step rebalancing strategy and applies guardrails like balance checks and slippage bounds before passing the intent downstream.

Session Key Framework The agent operates through Biconomy's session key system. Each agent wallet gets 10+ specific on-chain permissions. Approve token X for protocol Y. Deposit into pool Z within range limits. Withdraw when conditions trigger. These permissions are set once during onboarding. The agent can only execute pre-approved actions. No blank checks. No custody risk.

Biconomy's Supertransaction Orchestration Biconomy takes over execution. It bundles all operations into a single transaction, dynamically optimizes gas limits, and handles failures. If a pool interaction fails or liquidity conditions change mid-execution, the system adapts. All of this runs through a Nexus Smart Account under the hood, while the user still interacts with a regular EOA through Fusion, enabling gas abstraction and preserving ownership without altering the user’s wallet flow.

Completion & Verification Once execution completes, the agent receives structured feedback: transaction receipts, gas metrics, and performance outcomes. Every action generates a Zero-Knowledge Proof (ZK-proof), a cryptographic receipt that anyone can verify on-chain. Trust the math, not reputation.

The user only sees one thing: their capital working automatically, end-to-end. One deposit, one confirmation, one hash.

Real Example from Production

A liquidity provider deposits $HYPE into a pool on HyperEVM. The pool is performing well, earning yield within the optimal range.

Then market conditions shift. Volatility increases. The pool's range becomes suboptimal. Fees drop. The position starts losing efficiency.

Traditional approach: LP notices hours later (if they're watching at all). They manually withdraw from the pool. Calculate new range parameters. Manually redeposit. Pay gas twice. Miss yield during the entire gap.

KOPS approach: Agent detects the shift in real-time. Analyzes new market conditions. Calculates optimal new range. Withdraws, rebalances, and redeposits. All in one bundled supertransaction. LP wakes up to optimized returns.

The agent monitored. Biconomy executed. The LP earned.

The Security Model

Security is paramount. Agent wallets are created using the Coinbase Wallet API v2. Private keys are generated and permanently sealed within a Trusted Execution Environment (TEE), a highly isolated hardware module that makes them inaccessible to any party, including the KOPS protocol itself.

The agent operates through session keys. It's granted temporary, narrowly-scoped permissions to authorize specific, pre-defined actions. If the agent tries to operate outside its permissions, the transaction fails on-chain. The guardrails are cryptographic, not just UI-level.

And every action is verifiable. ZK-proofs provide mathematical certainty that transactions were the direct output of the agent's strategy logic, given the market data at that moment. This transforms the trust model. You don't have to trust KOPS' reputation. You can verify the math.

Why This Matters for DeFi

This collaboration proves that DeFi agents don't need to rebuild every layer of infrastructure. The future belongs to modular systems: intelligent agents that handle strategy and optimization, paired with specialized infrastructure that handles execution and security.

With Biconomy, DeFi agents get composable execution guarantees, gas abstraction, and session-based permissions out of the box. With KOPS, users get intelligent liquidity management that actually delivers what it promises.

The Bigger Picture

The KOPS-Biconomy partnership represents a new pattern for agent-native DeFi: intent-driven execution powered by modular infrastructure. And it’s already being pushed further - KOPS is also currently running a best supply yield AI Agent on HyperEVM aggregating the top lending markets, achieving 40-50% higher yields in comparison to idle depositors.

Instead of siloed development, it's a symbiotic model:

Agents for intelligence and strategy. Biconomy for orchestration and completion.

For users, that means DeFi agents that truly "just work." For developers, it means faster time-to-market, smaller stacks, and reliable composability across chains.

Agentic Liquidity Pools now have their execution layer, a modular infrastructure that can make their decisions real.

Ready to let your liquidity manage itself?

Try KOPS: kops.ai

Learn about Biconomy's infrastructure: Docs